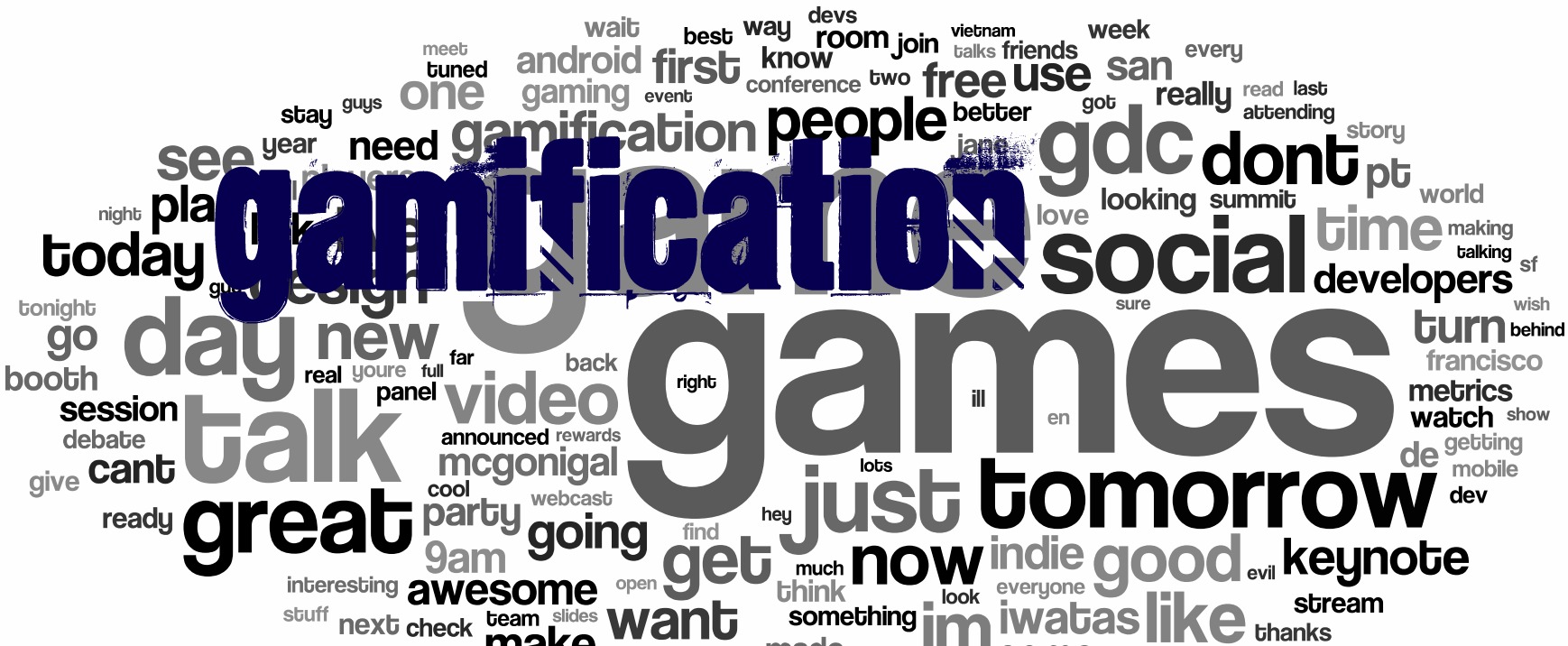

Gamification, one of those buzz words of the internet industry is definitely a powerful tool with everyone trying their hands on using different tactics to garner people’s interests or retain their customers by engaging them.

GreynGreen, also in the same league is currently exploring options in creating games to impart financial awareness.

We are looking forward to effectively educate people with the basics of financials by using a platform that blends serious personal finance management tools with fun and rewarding game dynamics. We truly believe that games are experts at making or breaking habits.

Though the idea of Personal Finance Games is not novel, we are planning to take a unique approach of integrating games into an already systematic programme of financial planning through consultations with independent CFPs, financial products and software.

Ex. The quite popular board game Business (or Monopoly), can be taken as an example in teaching a novice the fundamentals of running real estate business.

A brief on one of our game ideas –

It’s an online role based board game with three categories of squares. The idea is to help inculcate good personal finance habits using an interactive and dynamic platform and impart lessons like –

◦ Importance of Saving money

◦ Budgeting

◦ Living within your means

◦ Importance of Proper Planning

There are three categories of square

• Green – You earn here; The player is timed in this; eg. Delivering pizzas at the counter (Rs. X per order), Filling fuel in the cars (Rs. Y per car)

• Red – You spend here; eg. Go shopping for fruits and vegetables (the player has to play the whole process of shopping i.e. selecting which vegetables, what quantities etc), Buy a birthday dress for your child

• Blue – You earn extra money/ bonus (related to the character you choose); You avail it upon answering some question; eg., You earn Rs. X by teaching music, You earn Rs.Y by performing with dozens of other elite musicians

Look forward to all your thoughts/feedback on the same.

Thank you.