Today we launched Tavaga on the Play Store. Please do download, give it a spin and let us know what you think!

Now onto the main post:

Two years ago, a bunch of us got together and decided to start-up, like a lot of folks around us (starting-up was the coolest thing to do back then!)

So we started with brainstorming on a few questions:

- What are we truly passionate about?

- What is it that we really want to do?

- How can we leverage our backgrounds?

- What did the successful startups do to get there?

- What is the one core value we need to deliver to our customer?

After some back and forth we found our answers. We all had a strong background in finance, and were all quite passionate about it. The most successful start-ups like Uber and AirBnB offer a value to their customers that was much needed. The value proposition of these companies is so strong that their customers are willing to actively help these companies challenge regulators.

If so, what is the value that Tavaga should deliver to its customers?

Simplicity!

The world of finance is very complex, and when it comes to investing even more so. There are ‘market experts’ with half baked knowledge of finance, who keep puking names of stocks day in and day out on business news channels. They lace their speeches with a healthy dose of complex jargon to ensure they come across as experts. There is no way for normal people like us to figure out if they are any good at picking stocks.

Then there are ‘investment advisors’ running around with forms, and pitching funds with complex names like IXIXI Smart ABC XYZ Fund — Growth Option — Regular Plan. No one knows what that means, how it works or how it is going to help them reach their financial goals. You are told these are the best 2 or 3 of the 10,000 funds out there, and that you won’t be able to buy a house or send your child to a good college if you didn’t put all your money into this fund immediately. To prove the point, they will then inundate you with numbers and complex jargon that you don’t understand. None of this makes sense to anyone, but for the fear of losing out, we all give in and sign the papers.

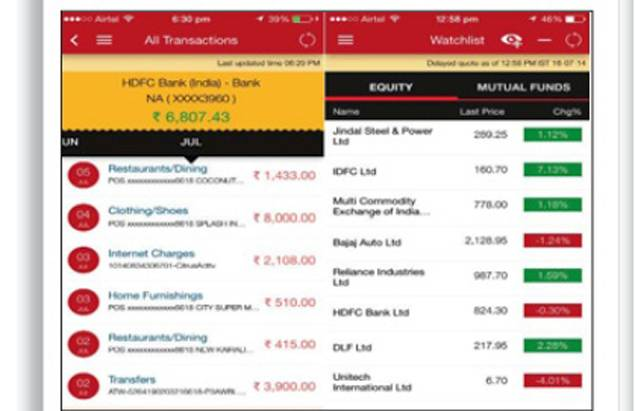

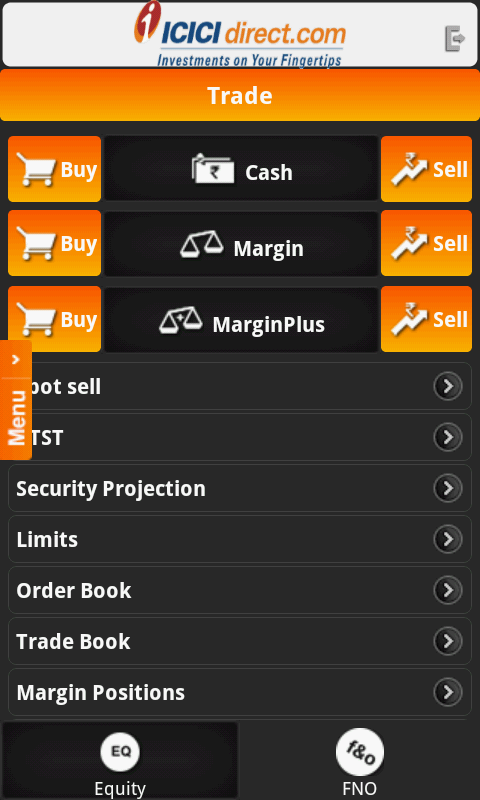

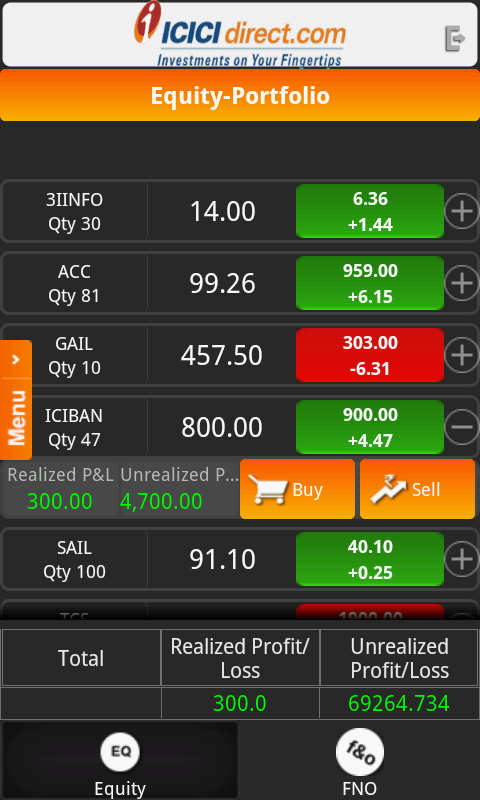

Do their apps do a better job? Not really. They are all just an app version of the same service — too many numbers, too much jargon, too much text — just too many things!

What the customer desperately needs is simplicity — numbers they understand, words they can relate to and most importantly, to feel that they are in control of their future, not the scary folks I described above.

And so Tavaga was born, with one value proposition:

‘Invest Simply!’

However, delivering simplicity is not easy. As we researched, we realised that the whole process is very complex from a customer perspective. They don’t know what they are buying, they don’t know if it is suitable for their needs, and they don’t know how to link these investments to their actual goals.

Typically the seller, be it a bank representative or a financial advisor, starts with pitching a fund to the customer. After either greed or fear sets in, customers are presented with a bunch of forms. One of them being a risk assessment questionnaire. This paper has questions like ‘What will you do if the markets fall by 20%?’, with options like — ‘stay invested, buy more, sell’. That gets the customer thinking — Wait a minute, didn’t the guy just say that this fund is going to go up by 20%? Why am I being asked about markets falling? What would I really do? I have no idea what I would do, because I was thinking only about the fund going up by 20% and what I’d do with the profit. What can I do with a loss?’. After 2 or 3 such questions, the customer just gives up, looks for the signature box and lets the agent fill in the rest of the form.

And then, a year later when the profit is nowhere close to the promised 20%, a different guy from the same bank shows up, tells you that the other guy was dumb and that he will move your money to the fund that ranked No. 1 last year. You are then left wondering if you are any closer to buying that house today than you were last year.

Delivering Simplicity!

Solving these problems was not simple. The questions in the risk assessment questionnaire are important, and we do need to understand the customer’s willingness to take risk. After that, we need to find a way to let the customer focus on what matters to them the most — their goals.

We set out to find a way to get our customers to answer the same questions without really answering any of those questions. Confusing?

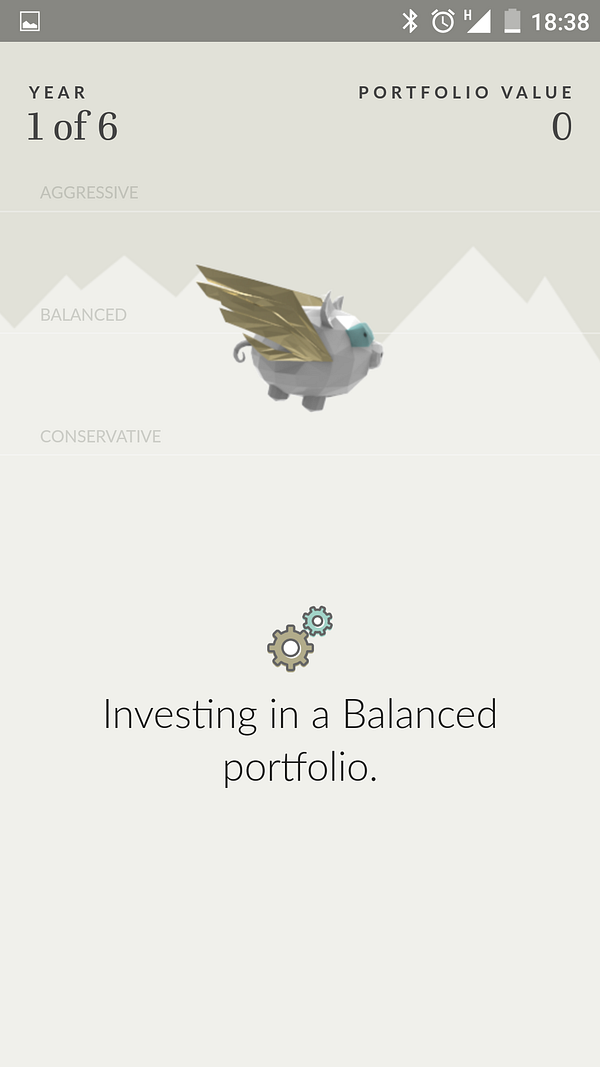

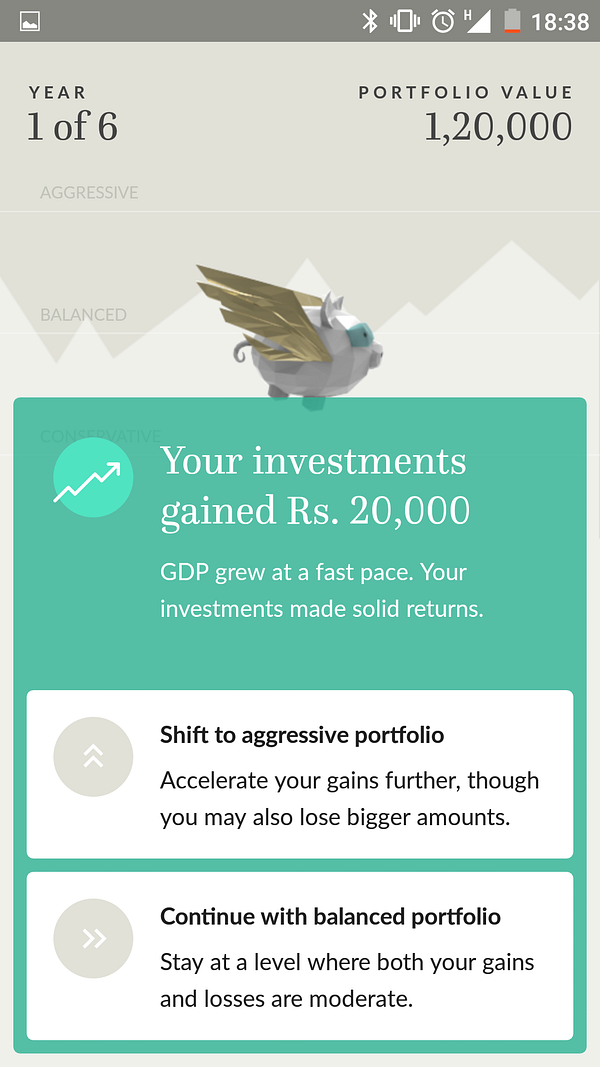

Enter the ‘Investor Attitude’ simulation.

We created a simple simulation game where the customer starts with a portfolio worth Rs. 1 lakh, and decides to increase or reduce the risk depending on the outcome of the simulation. This simulation runs for 6 periods and based on the decisions made by the customer, we deduce the answers to the same questions as in a questionnaire.

The customer is not bombarded with complex jargon, yet we get all the answers we want. And that’s how we simplified risk profiling!

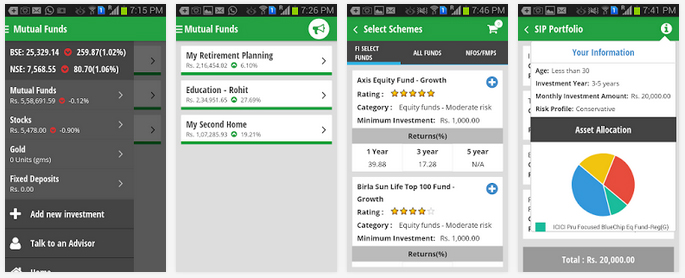

Then we had to figure out how to keep the customers focused on their goals, and not the names of the funds or the numbers they churn out every day.

How did we do that?

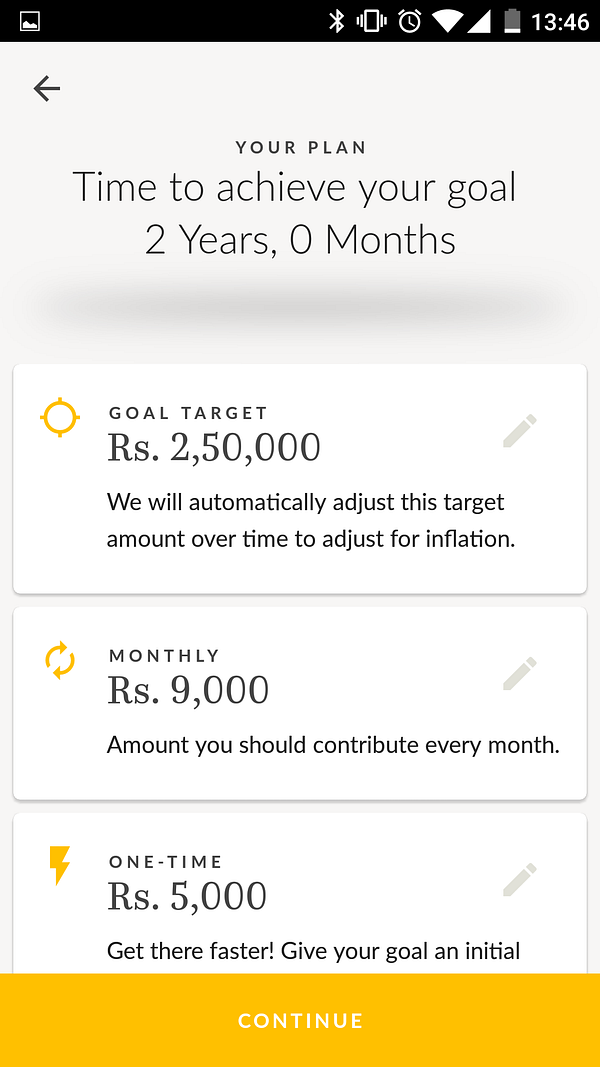

Step 1 — Create a simple interface for customers to tell us what they are saving for.

We built a simple flow where the customer inputs what their goal is, how much will it cost them and when they want to achieve the goal. Based on this input, we create a simple goal plan that tells them how much they need to save every month to reach their goal. If they think it is too high or low, they can always tweak it.

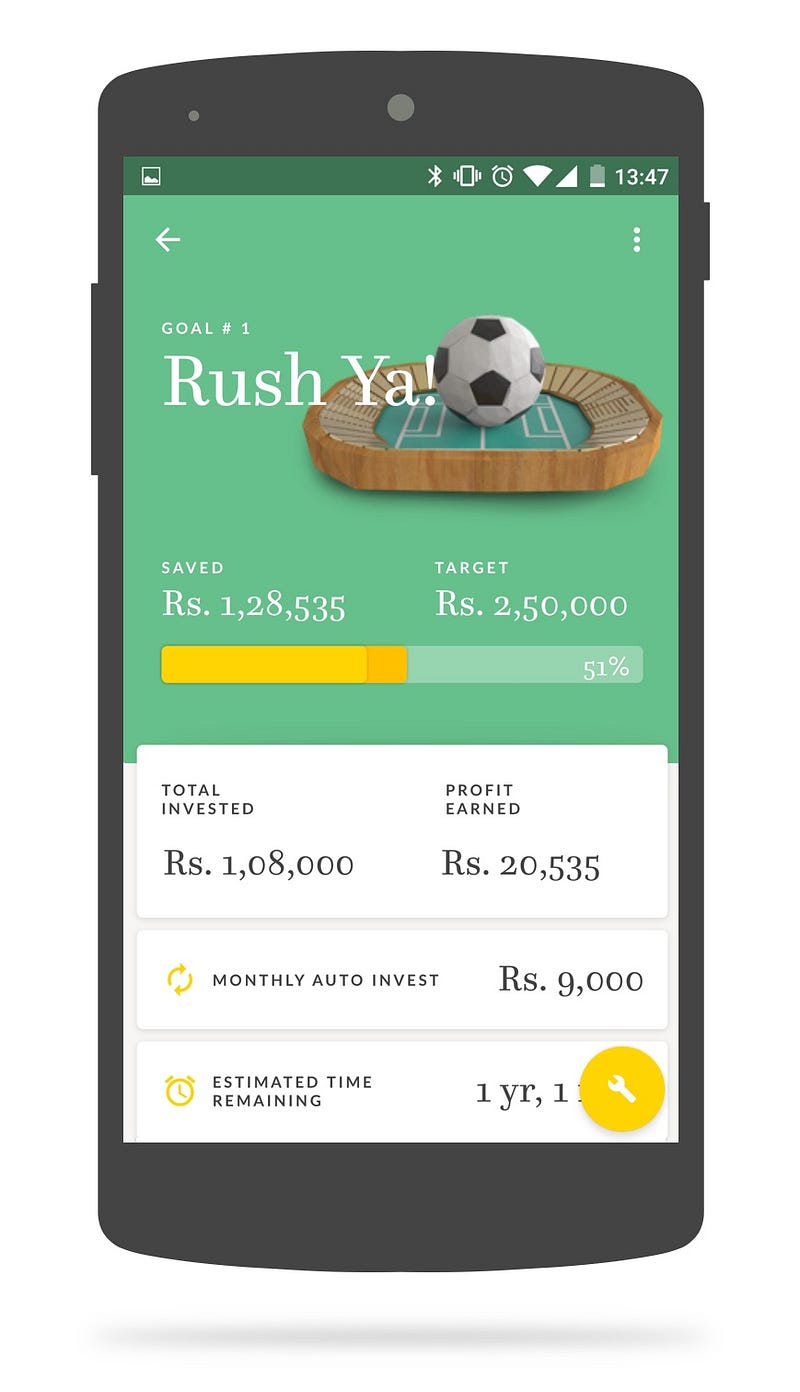

Step 2 — A goal dashboard.

When a customer opens the app, they don’t see funds and daily movements. They see their goals. They see how much they have invested towards a goal, how much of the target is completed, and how far they are from reaching their target. Do you really need to know anything more than this about your goals? We believe most people want to know just that much, and that is exactly what we show.

Delivering this simplicity didn’t come cheap. We spent a lot of time brainstorming, building prototypes, showing them to customers, going back to the drawing board, and repeating the whole process several times, before we had what we believed was simple enough.

Everything we built goes against conventional wisdom. Several industry experts wrote us off even before they saw the product. One particular “very reputed veteran” of this industry said that there are at least 500 really good ideas waiting to happen in fintech, and this definitely is not one of them. He recommended we shut down and go back to our jobs.

The time has finally come when customers will judge who’s right and who’s wrong 🙂

If you have read through till here, you’re clearly interested in the product. I would urge you to first download a few other apps like an ICICI or a ShareKhan, and then download Tavaga to experience the full impact of the simplicity. Once you give Tavaga a spin, do let us know what you think of it!

Ajit Singh

Since this is advisory business – what is the model? Is it commission fee based or performance based. I would be very keen to move my portfolio with you if you work on a performance fee. I pay my current advisor no commissions but only XX% of all profits above the prevailing rate of FD. This keeps everyone honest.Please let me know the risk profile and your fee model.

Amit Rohra

WOW ! Love it !! Hit the nail on the head with this one. Love the amount of time spent on really building the customer experience! Kudos, to the entire team! Rock on !

Niharika Rao

Hi Ajit, we will be revealing our pricing and risk details in the coming days. Please keep an eye out on our website for it!

Your advisor also gets paid by the AMCs for selling you their products, do remember that. 🙂

Meanwhile, please download the app if you haven’t already. Your feedback is valuable to us.

Niharika Rao

Thank you so much, Amit! Gotten some amazing feedback from you. 🙂

Do keep using the app and letting us know what you think.

Arjun Sarin

– The first screen of app and the headline along with the image is quiet clear on what this app intends to do. However adding a word “FINANCIAL“ just before goals would make more impact and even more clear what this app is all about.

– Limiting the app to just Google login may not be a good idea. You may also like to include the option of signing up with email. I as a user may not like to give your app permission for my Google account.

– Displaying terms and conditions in the app can be a good idea rather than making the consumer download a PDF. Although these are hardly read yet having them in-app on webview will be good idea.

– I played the investment game and was declared as an aggressive investor. I think there is a fundamental flaw in the theory being used to determine investor temperament, in none of the 6 moves I lost my capital, since I didnt loose my capital I continued being bullish. Real investor panic starts when they start to loose capital, you may probably like to tweak this.

– Once I played the game I was asked for my PAN number, probably a small line on why should I give my PAN to you can be incorporated. The calendar functionality for entering DOB has a very poor UX, here also if you can just let the user know why they should give their DOB to you will be great. And there is no way to see this info and review it, I may have made a typo in entering the PAN, and need to correct it. Both of this infos can be incorporated in the profile.

– A basic how it works, how would my goals be achieved, how investment cycle works should be incorporated in the app.

– Once my profile is set I could’t find a way to edit it, 3 months down the line I can change my phone number or my investment temperament may change depending on my financial conditions, – I think basic profile editing features should be present.

– I received email sent by sender name Arijit Sarkar, signed off by Ravikanth Dasika, may be you would like to make the amendment. Also moving your email account to Sendgrid over Mailchimp may result in better reach of the email landing in inbox (right now it ended in Promotions of mailchimp)

– Lastly, I think this app can be packed in a size less than 13.5 MB, I couldn’t find any reason for such high size for V 1 of the app.

Good luck.

PS: I deliberately chose to be a critic here because I believe that is your motive of asking feedback….

Niharika Rao

Hi Arjun,

Thank you for your very detailed feedback! It’s valuable to us and we will work hard to ensure that the smoothest experience is delivered to all our customers.

Arjun Sarin

One more thing Niharika, You can also enable a web version for Tavaga. This will help you gain organic traction through Google search.

Niharika Rao

Thanks, Arjun. A web version is in the works as well.

Alok Rodinhood Kejriwal

How’s it going guys?!

Niharika Rao

Working hard on all this amazing feedback! 🙂

Pratik chirania

I did pre sign up for your app, and got your emails, notifications, and reminders to install the app. But I am firm not to install your app.

The problem, I am pretty convinced you sold the pre sign up data to other interested companies working in the sector, who got highly targeted leads of people who had themselves provided their information to you.

I have never been a person who invests in market volatility, and have never ever expressed interest for the same, except once when I mistakenly signed up for your app. (That was more of too because of AlokJi’s recommendation).

I receive on an average 10 calls a week, and about 100 text messages a week. My number is registered with the DNC list, a thing which when I brought to the notice of one of the telecallers, he said I had registered with some company, and so was receiving this calls despite the DNC.

Please don’t use underhanded tricks, you are only killing the ecosystem, by making just one more person averse to ever doing a Pre-Sign up for any other app ever.

Please say I am wrong, and I will happily apologize for pointing my finger in the wrong direction.

Niharika Rao

Hi Pratik,

We have never and will never share your or any other subscriber’s information with anyone else.

If you have any evidence suggesting that it was OUR company and not another that had shared your information with third parties, please provide it to us so that we may act against this transgression. Nobody but the team responsible for customer onboarding has access to information pertaining to any customer or potential customer.

Please do file a complaint with the Telecom Regulatory Authority of India here: https://www.tccms.gov.in/Queries.aspx?cid=1

Thank you for giving us the opportunity to clear this issue up for you.

Meanwhile, please refrain from asserting that your information had been shared by a particular party (in this case, Tavaga) without presenting any evidence in support of your claim.

Regards,

Niharika

Pratik chirania

I do not have proof per se that it was your company and not any other, except for the fact that, the only place I have I shared my details regarding Fintech was only with your app during the Pre-Signup. And the only calls I am receiving are all Fintech based companies.

I do apologize for pointing out your company. I guess I am gonna have to deal with them anyways.

Niharika Rao

Hi Pratik,

Thank you for the apology, appreciate it.

Based on your assertions, your suspicion does seem somewhat justifiable. However, you had only provided us with your email and never your phone number, so we could not have shared it anyway.

In any case, do download the app and give it a spin. We promise to do our best to work with you! 🙂

Best,

Niharika